Securing a home is a significant milestone, and for veterans, understanding the va loan pre approval process is crucial. This process, while offering significant benefits, can be intricate, demanding extensive documentation and a thorough review of financial history. Successfully navigating this process directly impacts a veteran’s ability to purchase a home, especially in competitive markets. This guide provides a step-by-step explanation of the VA loan pre-approval process, clarifying common challenges and misconceptions to help veterans achieve their homeownership goals.

Toc

- 1. Understanding VA Loan Pre-Approval and Eligibility

- 2. Gathering Documents and Choosing a Lender for Your VA Loan Pre-Approval

- 3. Completing the VA Loan Pre-Approval Application and Understanding Your Credit Score and DTI

- 4. The Underwriting Process and Determining Your VA Loan Pre-Approval Amount

- 5. Related articles 02:

- 6. Timeline and Tips for a Smooth VA Loan Pre-Approval

- 7. Current Trends Impacting VA Loan Pre-Approval

- 8. Conclusion

- 9. Related articles 01:

Understanding VA Loan Pre-Approval and Eligibility

When considering a VA loan, it’s essential to understand the difference between pre-qualification and pre-approval. Pre-qualification is typically a quick, informal assessment based on self-reported financial information, while pre-approval involves a thorough examination of your financial history by a lender. This distinction is critical; obtaining a VA loan pre-approval signals to sellers that you are a serious buyer with the financial backing necessary to proceed.

However, it’s important to note that pre-approval does not guarantee loan approval. It serves as a strong indication of your likelihood of obtaining a loan, as lenders assess various factors including your credit history, debt-to-income ratio (DTI), and employment stability. For example, a veteran with excellent credit and a low DTI is far more likely to receive a pre-approval than one with poor credit and high debt.

Eligibility Criteria for VA Loans

To be eligible for a VA loan, certain criteria must be met. Veterans must have served a minimum period, which varies depending on whether the service occurred during wartime or peacetime. Specifically, active-duty members should have served at least 90 days during wartime or 181 days during peacetime. Additionally, members of the National Guard or Reserves must typically serve at least six years to qualify.

Surviving spouses of veterans may also be eligible for VA loans, particularly if the veteran died in service or due to a service-related disability. A crucial component of the eligibility process is obtaining a Certificate of Eligibility (COE). This document verifies your entitlement to a VA loan and can be obtained through the VA’s online portal, a lender, or via mail.

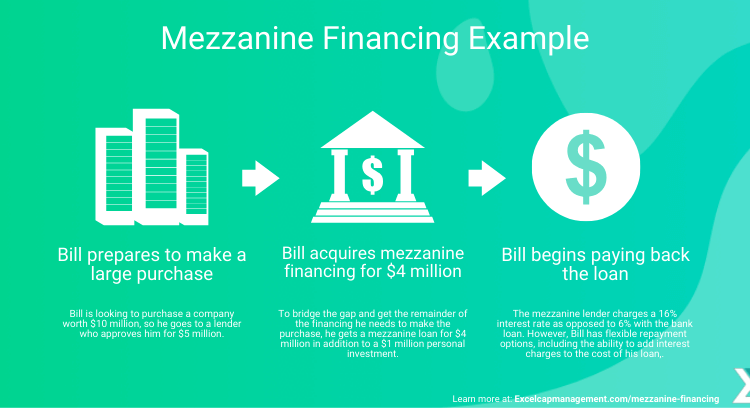

Alternative Financing Options

While VA loans offer unique benefits, it’s worthwhile for veterans to consider alternative financing options, such as FHA loans or conventional loans. These alternatives may be preferable in certain situations, particularly if a veteran does not meet the VA’s eligibility criteria or seeks different terms. Exploring all options ensures veterans make informed decisions that best suit their financial situations.

Common Misconceptions

Many veterans believe that the VA loan program guarantees easy access to home financing, but this is not entirely accurate. One prevalent misconception is that a VA loan pre-approval does not require a credit check. While the VA does not set a minimum credit score, most lenders prefer a score of 580 or higher. Understanding these nuances can help veterans prepare better for the pre-approval process.

Gathering Documents and Choosing a Lender for Your VA Loan Pre-Approval

Essential Documents for VA Loan Pre-Approval

The first step in the VA loan pre-approval process is gathering the necessary documentation. Essential documents include:

- Government-issued photo ID: This could be a driver’s license or passport.

- DD Form 214: This document is crucial for veterans as it outlines your military service.

- Certificate of Eligibility (COE): This verifies your eligibility for a VA loan.

- Recent pay stubs: Typically, lenders will ask for the last two to three months of pay stubs to verify income.

- W-2 forms: These forms help lenders assess your annual income.

- Bank statements: Providing the last two to three months of bank statements can demonstrate your financial stability.

It’s important to note that some lenders may require additional documentation depending on individual circumstances, such as tax returns or proof of assets. Creating a checklist can help ensure that you have everything you need when applying for pre-approval. Organization streamlines the process and minimizes stress during the application phase.

Selecting a Reputable Lender

Choosing the right lender is a critical step in the pre-approval process. Look for VA loan pre-approval lenders who have a strong track record and are well-versed in VA loan specifics. You can choose between direct lenders and mortgage brokers, each with its pros and cons.

Direct lenders may offer more straightforward communication and faster processing times, while brokers can provide a range of options from various lenders. It’s advisable to conduct research and read reviews to find reputable VA loan pre-approval lenders. Online platforms like “VA loan pre approval reddit” can offer valuable insights from other veterans’ experiences with different lenders. Don’t hesitate to negotiate with lenders regarding interest rates and fees, as this can lead to better terms and conditions for your loan.

Completing the VA Loan Pre-Approval Application and Understanding Your Credit Score and DTI

The Application Process

Once you have selected a lender and gathered your documents, you can move on to completing the application. This will involve providing detailed information about your employment, income, debts, and assets. Being thorough and accurate in your application can help expedite the process.

Credit Score and Debt-to-Income Ratio (DTI)

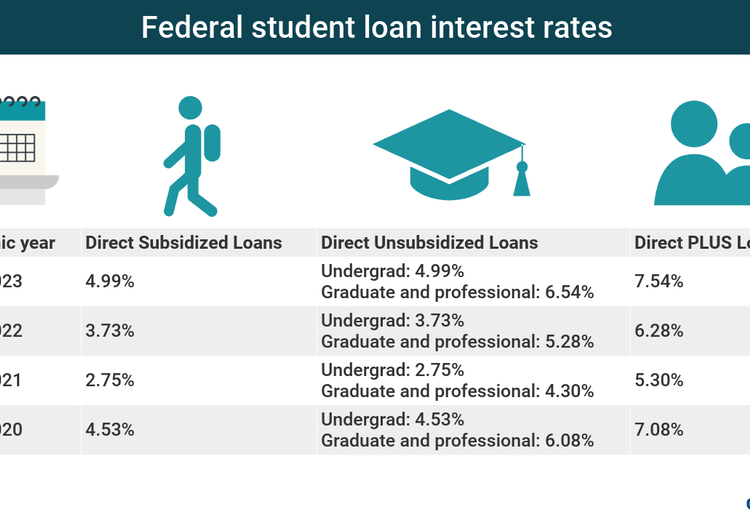

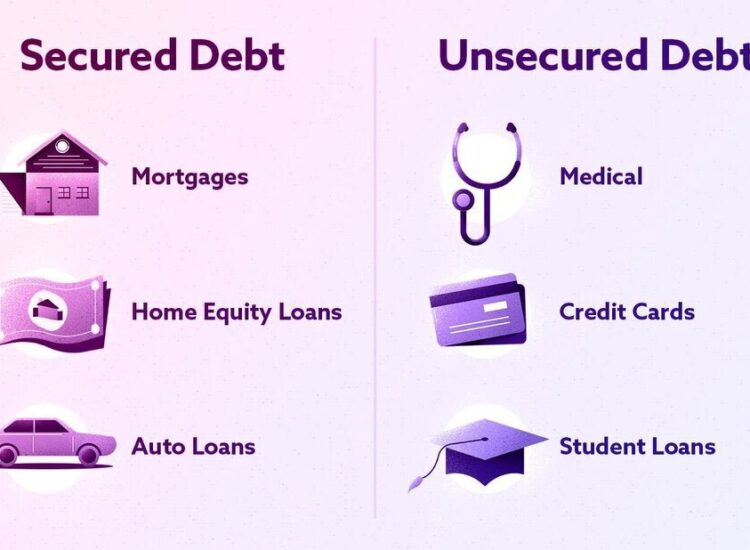

A significant aspect of the pre-approval process involves assessing your credit score and DTI ratio. While the VA does not set a minimum credit score, many lenders prefer a score of 580 or higher. Some lenders may work with veterans having lower scores, but this could result in higher interest rates or stricter terms.

The DTI ratio is calculated by dividing total monthly debt payments by gross monthly income. A healthy DTI ratio, typically not exceeding 41%, is also essential for approval. For veterans wondering about “VA loan pre approval no credit check” options, it’s important to note that lenders will still conduct a credit check, albeit with more lenient criteria than conventional loans. If your DTI is higher, consider strategies to reduce it, such as paying down existing debts. Resources like a “VA home loan pre approval calculator” can be incredibly helpful in estimating your borrowing power based on your financial situation.

The Underwriting Process and Determining Your VA Loan Pre-Approval Amount

Understanding Underwriting

After submitting your application, it enters the underwriting phase. This is where the lender reviews all your financial information, assesses the risks, and determines the loan amount you may qualify for.

The Appraisal Process

An appraisal may also be ordered to evaluate the home’s value, ensuring it aligns with the loan amount. This step is crucial as it protects both the lender and the borrower by confirming that the loan amount reflects the home’s market value.

Risk Assessment by the Underwriter

The underwriter will analyze various factors, including your credit score, income, DTI, and the appraised value of the home. Understanding how your pre-approval amount is determined is vital for your home search. Many veterans seek clarity on the “VA loan pre approval amount reddit” discussions, which often reveal personal experiences and tips regarding expected loan amounts.

1. https://khositrangsuc.com/mmoga-sofi-loan-consolidation-your-guide-to-simplifying-debt/

3. https://khositrangsuc.com/mmoga-find-the-best-small-business-line-of-credit-loan/

4. https://khositrangsuc.com/mmoga-parent-plus-loan-consolidation-your-complete-guide/

Additionally, VA loan limits can vary by county, affecting the maximum loan amounts available. For a clearer picture, utilizing a VA home loan pre-approval calculator can help you estimate your borrowing power based on your financial situation.

Timeline and Tips for a Smooth VA Loan Pre-Approval

How Long Does It Take to Get a VA Loan Pre-Approval?

One common question among veterans is, “How long does it take to get a VA loan pre approval?” The answer can vary, but the process typically takes a few days to a couple of weeks. Factors influencing this timeline include the completeness of your application and the efficiency of the lender. For instance, “VA loan pre approval Navy Federal” is known for its streamlined process, but experiences can differ from lender to lender.

To speed up the pre-approval process, ensure that your documentation is complete and readily available. Frequent communication with your lender can also help keep things moving smoothly.

Tips for a Seamless VA Loan Pre-Approval Experience

To maximize your chances of a successful pre-approval, consider the following tips:

- Stay Organized: Keep your documents in order and easily accessible.

- Understand Your Benefits: Familiarize yourself with the advantages of VA loans, such as no down payment and no PMI.

- Ask Questions: Don’t hesitate to seek clarification from your lender on any aspect of the process.

- Maintain Good Communication: Regularly update your lender on any changes in your financial situation.

Current Trends Impacting VA Loan Pre-Approval

Increased Interest Rates and Their Impact

Recent trends indicate that rising interest rates are directly affecting the affordability of homes for veterans. Increased rates can lead to smaller loan amounts even with the same income and credit score, making it essential for veterans to stay informed about the current market conditions.

Digitalization of the Application Process

The increasing availability of online application portals and digital document submission is another significant development. This shift toward digitalization speeds up the process for many veterans, making it easier to complete applications and submit necessary documents without the hassles of traditional paperwork.

Conclusion

Successfully obtaining VA loan pre-approval is a crucial step in realizing your dream of homeownership. By understanding the process, eligibility requirements, and what to expect, you can navigate the journey with confidence. Whether you’re ready to start searching for your new home or simply exploring your options, reaching out to a knowledgeable VA lender can set you on the path to success.

Take charge of your home buying journey today, and enjoy the benefits that come with being a veteran. This comprehensive guide not only empowers veterans with the knowledge they need but also emphasizes the importance of proactive engagement in the VA loan pre-approval process. With the right preparation and understanding, veterans can navigate the complexities of home buying with confidence and clarity, ultimately securing the home of their dreams.